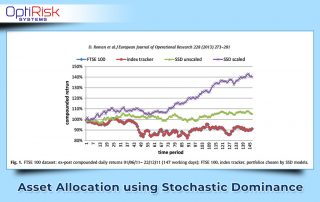

Asset Allocation using Stochastic Dominance

Portfolio Construction and Asset Allocation

Stochastic Dominance has been applied in the domain of finance for several decades. It is most commonly applied in investment and the economics of uncertainty (e.g., portfolio diversification, defining risk, estimating bankruptcy risk, capital structure, and determining option’s price bounds).

Modelling and Alternative Data in Finance

Let us start with the question what is Alternative data in finance? It refers to data used to obtain insight into the investment process

EPAT(NSA) Specialization with OptiRisk

EPAT News, Sentiment and Alternative Data is a specialization of the renowned Executive Program in Algorithmic Trading (EPAT) course.

OptiRisk’s Sentiment Enhanced Signals (SES) Model for Hang Seng

OptiRisk’s SES (Sentiment Enhanced Signals) Strategy for Hang Seng 50 uses Second Order Stochastic Dominance as its backbone.

Our Award-Winning Research Paper

OptiRisk is proud to announce that our research paper – “Forecasting crude oil futures prices using global macroeconomic news sentiment” is awarded the “Best Paper in 2020” by the IMA Journal of Management Mathematics. The paper is on our research on a modelling approach that employs global macroeconomic news sentiment to predict stock volatility or futures prices of crude oil.

OptiRisk Online Events 2020: From COVID-19 to AI, ML & Sentiment Analysis

All aspects of our lives: political, economic, social and technological (PEST) have been adversely affected by COVID-19. The impact on financial markets has been unprecedented and much more than any other major financial crises the global financial community has ever witnessed.

Handbook of Sentiment Analysis in Finance

News is an event; news and microblogs by market participants (investors, dealers, brokers and market makers) make up the 'market sentiment'. The collective sentiment influences and moves the market.

Asset Allocation Strategies: Enhanced by News

Traders and quantitative fund managers are always in the hunt for asset allocation strategies for trading and/or portfolio rebalancing. Their aim is to find the best absolute return or alpha. OptiRisk Systems has reported research results of enhancing asset allocation strategies with news sentiment.

About Sentiment Enhanced Signals: SES™

OptiRisk’s proprietary stock trading signals product. The investment industry manages funds in excess of $60tn globally. Passive fund management has seen an accelerated growth. Whereas managers of 'Active' funds seek to deliver a return in excess of a given market (index) and charge fees of 0.3- 1.0% per annum;