Asset and Liability Management Software Investing in Indices, Bonds and Swaps

Liability Driven Investment Optimization (LDIOpt) is an asset and liability management software (ALM) for pension funds, insurance companies, and banks. It’s optimization modelling tool enables the user to analyse their current investment portfolio, rebalance it to a new portfolio using advanced stochastic optimization models which take into account future uncertainties of the assets and liabilities.

Features of this software include:

- Asset and Liability Management under Uncertainty

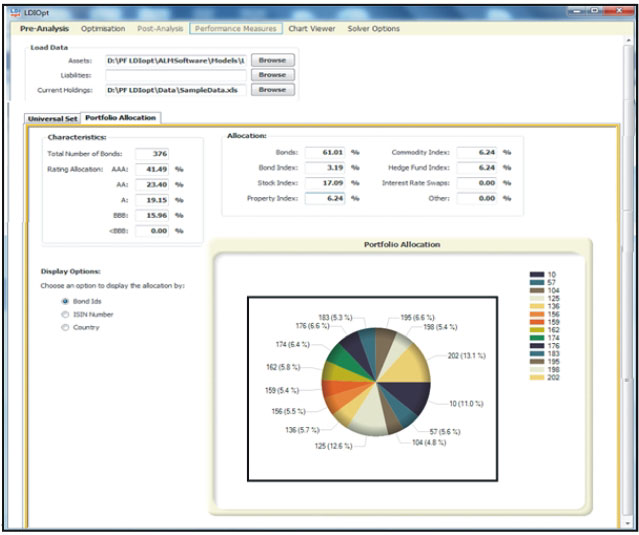

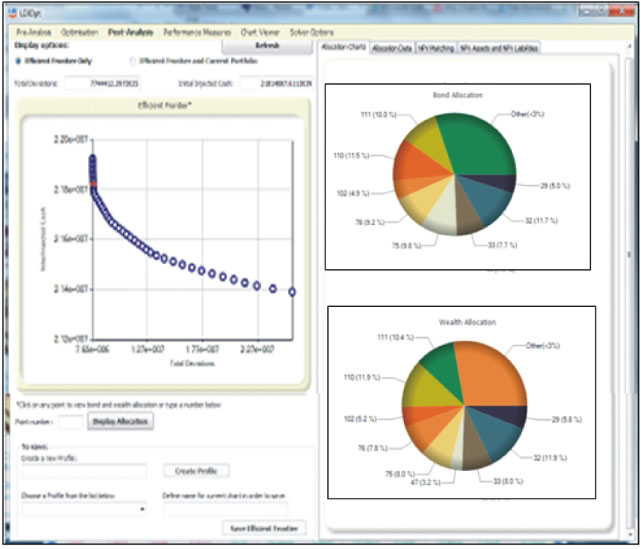

- Pre and Post Analysis of the portfolio

- Portfolio Allocation

- Scenario Generation

- Multiple Optimization Models

- Selection of bonds with creation ratings and sectors

- Supports investment option in bonds, indices, swaps

Software Demo Video

ALM Under Uncertainty

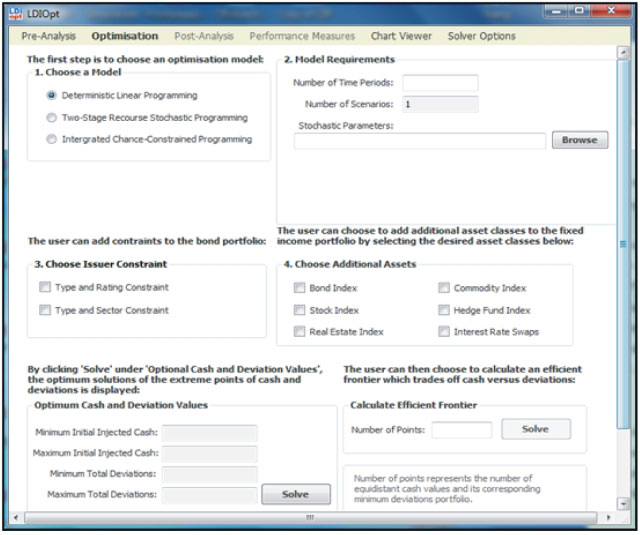

The optimization model behind this software can be selected by the user. The three mathematical programming models of choice are: (i) deterministic linear programming (ii) two stage stochastic programming with recourse and (iii) integrated chance constrained programming. All these models are able to account for Asset and Liability Management under uncertainty.

The goal of the underlying models is to minimize initial injected cash while at the same time minimizing total present value deviations between assets and liabilities. The optimal portfolio can be constrained by setting upper and lower limits for certain rating and sectors of the bond portfolio.Investment asset classes are:

• indices such as a bond index, stock index, real estate index, commodity index or hedge fund index.

• bonds

• cash

It also offers the option to use overlay strategies with interest rate swaps. The performance of any portfolio can be evaluated using different measures. We use the most common ones:

From academia: • Solvency ratio • Funding ratio • Standard Deviation or tracking error • Sharpe ratio • Jensen Index

From industry practice: • Sortino ratio • Treynor ratio • Information ratio • M-Square Alpha