OptiRisk’s proprietary stock trading signals product.

The investment industry manages funds in excess of $60tn globally. Passive fund management has seen an accelerated growth. Whereas managers of ‘Active’ funds seek to deliver a return in excess of a given market (index) and charge fees of 0.3- 1.0% per annum; in contrast the ‘passive’ funds use models which track the market (index) and charge much lower fees. In recent years, there has been a trend towards designing hybrid ‘enhanced index’ or ‘index-plus’ funds with a similar cost to index-trackers, but with some of the upside potential of the active funds. OptiRisk is a market leader in this domain and has built its own stock trading signals product.

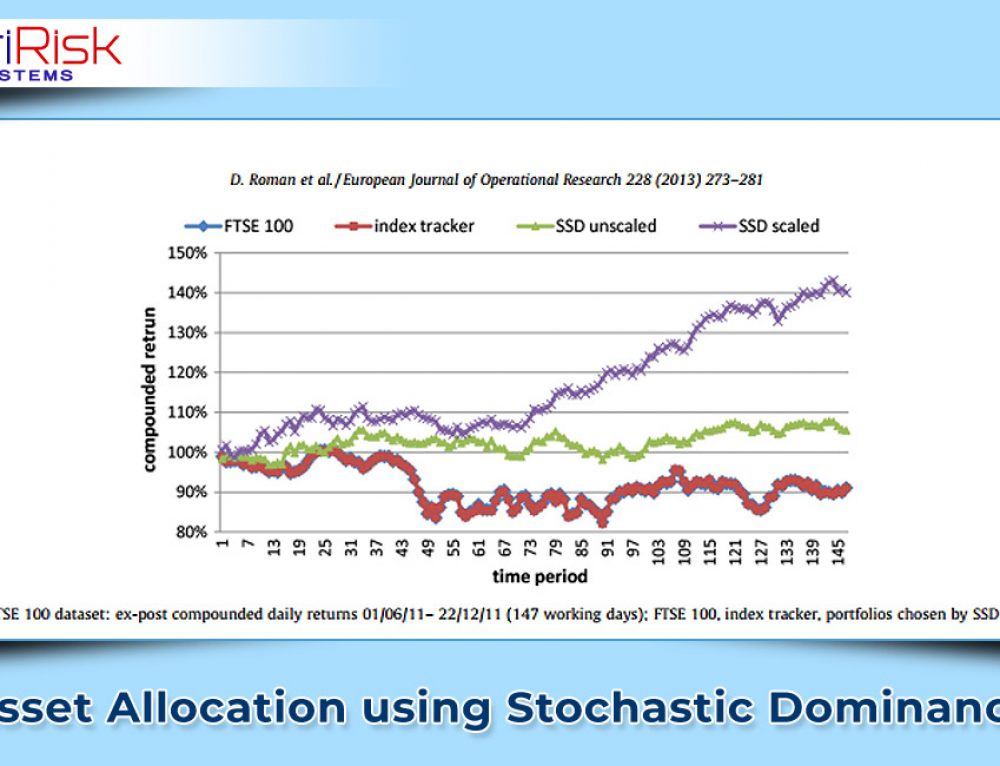

Modern Portfolio Theory (MPT) of Markowitz has a great standing in the finance industry; it uses Quadratic Optimization and has two sided risk measure of Standard Deviation. OptiRisk employs one-sided risk measure of ‘Tail Risk’. The optimization models are based on Second Order Stochastic Dominance (SSD). SSD is used because it shortens the ‘Tail’ at the same time opens up higher expected return ‘the Up-Side’. These and other work such as that of celebrated work of Professor Sortino (Sortino Index) constitute Post Modern Portfolio Theory (PMPT). OptiRisk further enhances this PMPT approach using market sentiment data, typically Newswires and Micro-blogs: Twitter Feeds.

More details are available here

OptiRisk also uses a simplification of the celebrated Kelly Strategy for gambling. OptiRisk as a Financial Analytics company has presented their results in leading forums of BFSI events in London, Zurich, Mumbai and Hong Kong. It has also created a joint portal with SMC Global: Trade SES

To know more about OptiRisk’s services, call us on +44 (0)1895 819 483/488 or send us an e-mail on info@optirisk-systems.com