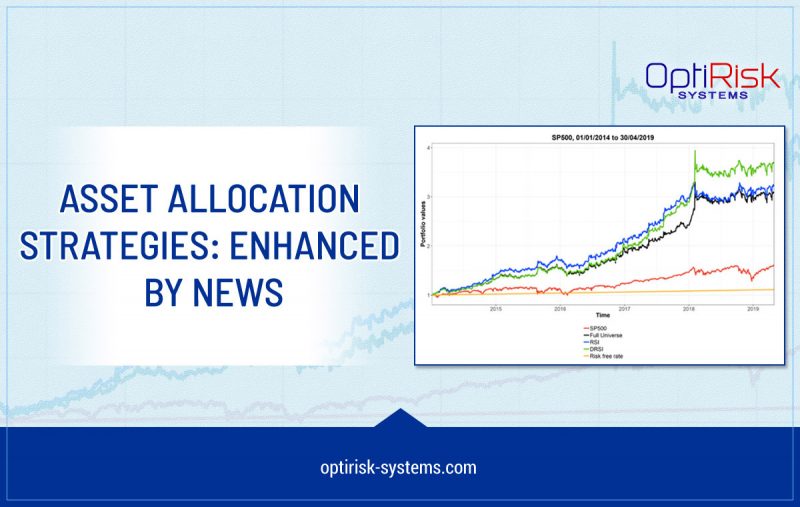

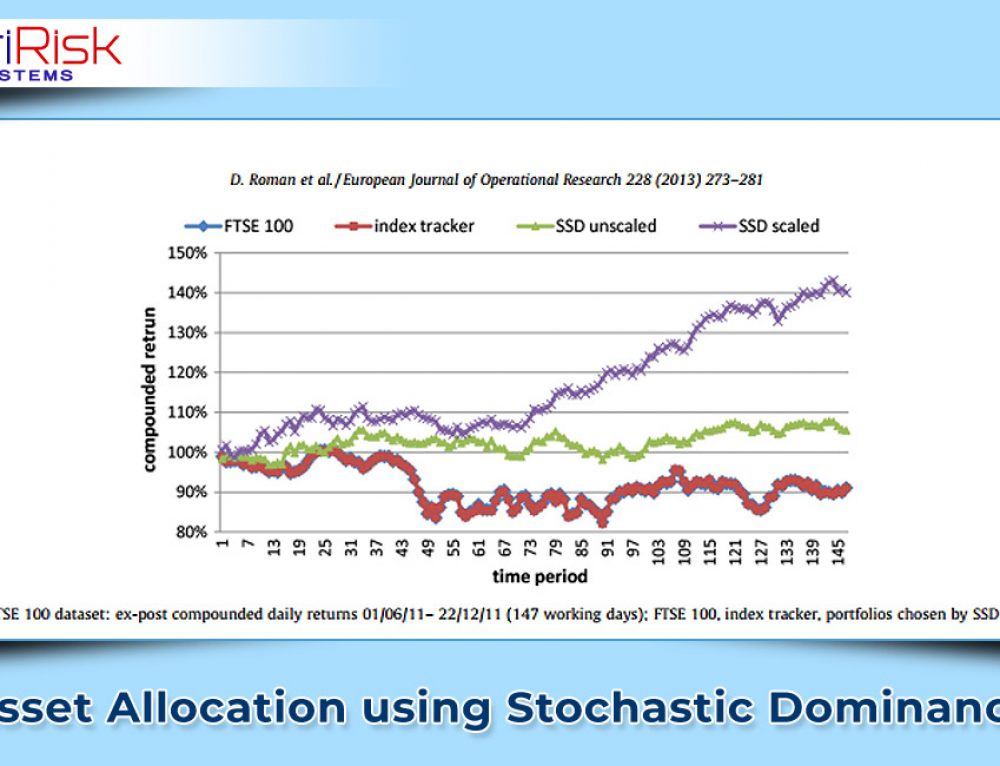

Traders and quantitative fund managers are always in the hunt for asset allocation strategies for trading and/or portfolio rebalancing. Their aim is to find the best absolute return or alpha. OptiRisk Systems has reported research results of enhancing asset allocation strategies with news sentiment. A novel asset filter is applied to OptiRisk’s proprietary asset allocation model of Second Order Stochastic Dominance (SSD). The asset filter is constructed using (i) Market Data and (ii) News Sentiment Meta Data as supplied by Alexandria Technology. The asset filters are used in the asset allocation model to restrict the choice of long and short positions of assets as they appear in the asset universe of the available assets. Historical Market (price) data is used to compute a well-known technical indicator which is the Relative Strength Index (RSI(t)) at time: ‘t’. It takes into account a stock’s recent gains and its recent losses. RSI (t) in turn, is used to identify oversold or overbought assets.

In a comparable way the News RSI (NRSI(t)) is computed; the authors have used the values of positive and negative impact scores computed for each stock to obtain NRSI(t). Computing impact of news using initial news sentiment is another innovation of OptiRisk Systems. The markets are moved by a ‘News Event’, however the influence of News decays over time. The definition and multiple uses of News Impact; positive and negative are described in the whitepaper An Impact Measure for News: Its Use in Daily Trading Strategies. The Scores RSI(t) and NRSI(t) are then linearly combined and thereby a derived filter DRSI(t) is computed. Back-Testing results are reported for RSI(t), NRSI(t), and DRSI(t). It is shown that the DRSI(t) filter performs well and gives the best results. The technical report has been peer reviewed and published on the Social Science Research Network (SSRN).

Follow the link if you wish to find out more about the research done by OptiRisk Systems: Asset Allocation Strategies: Enhanced by News.