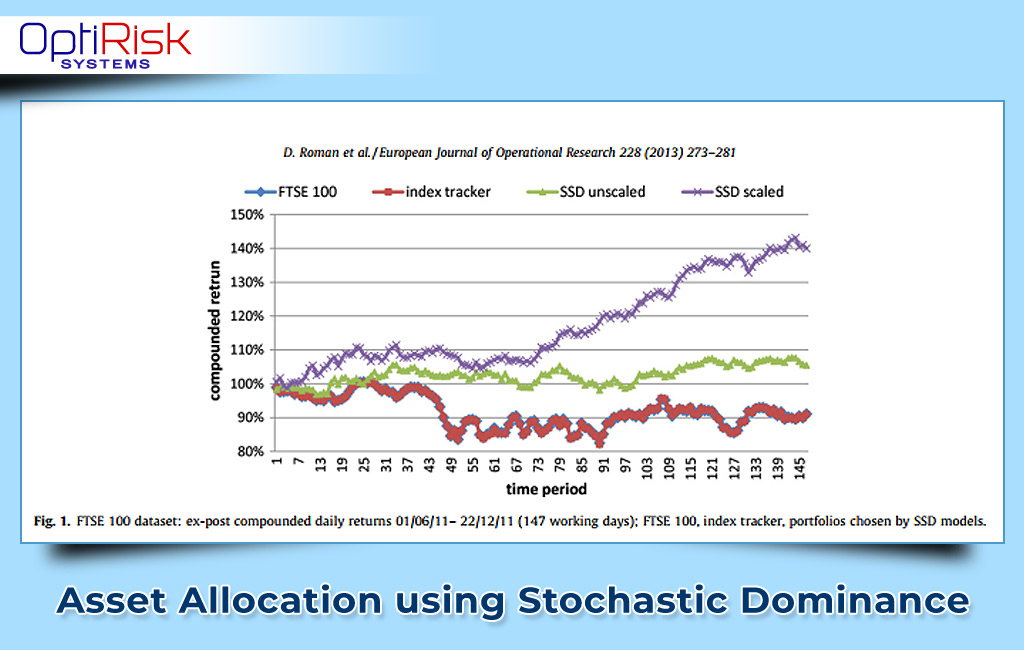

Asset Allocation using Stochastic Dominance

Portfolio Construction and Asset Allocation

Stochastic Dominance has been applied in the domain of finance for several decades. It is most commonly applied in investment and the economics of uncertainty (e.g., portfolio diversification, defining risk, estimating bankruptcy risk, capital structure, and determining option’s price bounds).

Modelling and Alternative Data in Finance

Let us start with the question what is Alternative data in finance? It refers to data used to obtain insight into the investment process

EPAT(NSA) Specialization with OptiRisk

EPAT News, Sentiment and Alternative Data is a specialization of the renowned Executive Program in Algorithmic Trading (EPAT) course.

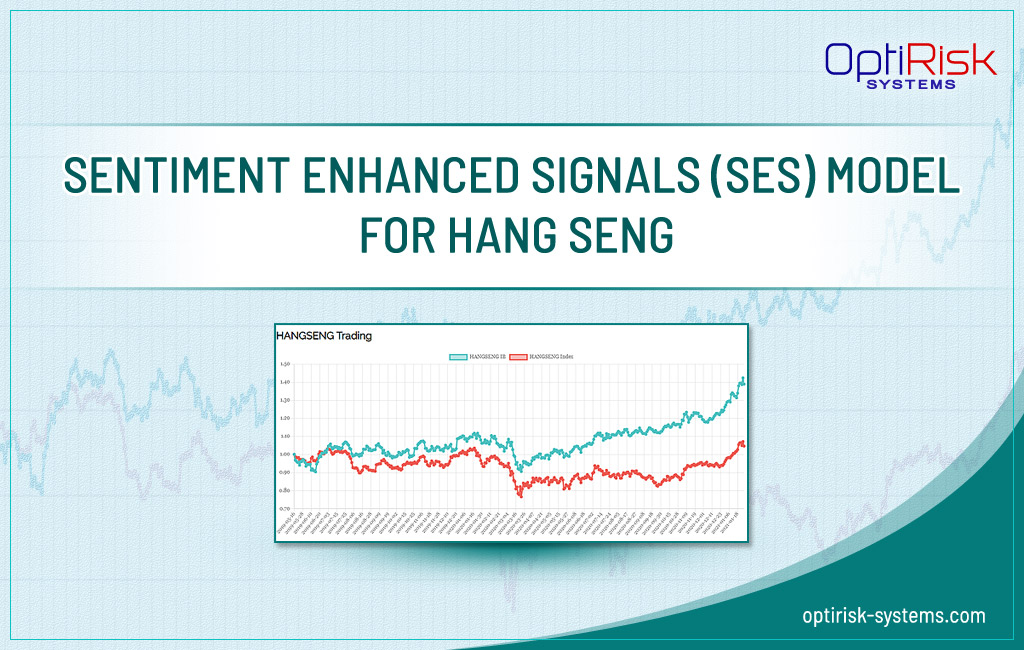

OptiRisk’s Sentiment Enhanced Signals (SES) Model for Hang Seng

OptiRisk’s SES (Sentiment Enhanced Signals) Strategy for Hang Seng 50 uses Second Order Stochastic Dominance as its backbone.