Sentiment Analysis Week: Behavioural Models & Sentiment Analysis Applied to Finance, 16 - 20 June 2014

We commissioned this conference & seminar series and our sister company, UNICOM, managed the event.

The week comprised:

Pre-conference workshop: Market Microstructure, Liquidity & Automated Trading, 16 -17 June

Conference: Behavioural Models & Sentiment Analysis Applied to Finance, 18 -19 June

Post-conference workshop: Sentiment Classification & Opinion Mining Using News Wires and Micro Blogs, 20 June.

Venue: Millennium Hotel London Mayfair

Presenters included thought leaders from round the globe and the conference was attended by a very interested community of researchers from the finance industry. Here is the blog of the conference.

The event has been recorded by our partner FitchLearning. The recording is going to be available. To access the recording, please email to info@optrisk-systems.com

APMOD 2014 -Warwick Business School

APMOD (Applied Mathematical Programming and Modelling) is a series of conferences which was started in 1991 on the initiative of Prof. Gautam Mitra, Brunel University/ London. www.apmod2014.org

OptiRisk Systems was a proud sponsor of APMOD 2014, the International Conference on Applied Mathematical Optimization and Modelling, held this year at Warwick Business School. Prof. Gautam Mitra, Dr. Christian Valente and Dr. Cristiano Arbex-Valle from OptiRisk were invited guest speakers. Prof. Gautam Mitra also delivered the closing keynote talk “ The Future Direction of Analytics”.

INFORMS 2014 - Boston

OptiRisk Systems exhibited at INFORMS Conference on “Business Analytics and Operations Research” in Boston on March 30 - April 1 http://meetings2.informs.org/analytics2014/

Christian Valente delivered a lecture: “Stochastic Programming, Robust Optimisation and the cloud”

OptiRisk Systems organised a series of webinars in the run-up to the conference “Behavioural Models and Sentiment Analysis Applied to Finance”. The feedback from the participants was extremely positive and they remarked that the webinars were valuable and thought provoking.

No. |

Date |

Presenters |

||

|

1. |

19 March |

The Sentimental Market Hypothesis: How Crowd Emotion Drives Market Prices |

||

|

2. |

2 April |

News Analytics - Using a Language Recognition Algorithm to Analyse News Flow |

||

|

3. |

16 April |

Compositional Sentiment Analysis

|

||

|

4. |

29 April |

Non-Linear Or Multi-Dimensional Approaches to Using News Sentiment

|

||

|

5. |

7 May |

Sentiment, News and Volatility in both Stock Returns and Trading Volume |

||

|

6. |

14 May |

Developing News Sentiment Signals for Medium – Frquency Trading Strategies |

||

|

7. |

21 May |

Social Media Applied to Finance

|

These webinars are recorded.

To download a recording, please contact info@optrisk-systems.com

AMPLDev version 3.0 has now been released, it now supports content assist and fine tunes many features according to user feedback.

AMPL API for Java is now under Beta release and is available at www.ampl.com.

MATLAB and R versions of AMPL API are currently in progress.

The AMPLDev and FortSP manuals are currently going through discussion and update.

The Handbook of News Analytics in Finance (published 2011) is a landmark publication bringing together the latest models and applications of News Analytics for asset pricing, portfolio construction, trading and risk control. Designed to provide a rapid yet comprehensive understanding of this topic, the book begins with an overview of News Analytics (NA), and an explanation of the technology and applications.

The new Handbook is titled "Handbook of Sentiment Analysis in Finance”

Publication Date: November, 2015

Building on the success of this Handbook, we are researching and compiling an update. The latest edition will include different sources of information such as

(i) News wires

(ii) Macro-economic announcements

(iii) Social Media

(iv) Micro Blogs/Twitter

(v) Online (search) information e.g. Google Trends

The applications of sentiment analysis are considered for multiple asset classes including

(i) Equities

(ii) Fixed income instruments

(iii) Foreign exchange

(iv) Commodities (Oil, Gas, Energy and others)

(v) Green commodities

Call for contributions: You may contribute to the Handbook in one of the following ways:

(i) write a technical article.

(ii) write a review chapter in the book.

(iii) become a finance industry sponsor and provide technical article(s).

(iv) supply an application case study.

(v) supply a listing of your company and summary details of your products and services in this domain.

All contributions will go through a due peer review process

Please write to: Xiang@optirisk-systems.com

OptiRisk welcomes:

- 1. Dr. Xiang Yu, Financial Modelling Researcher as a staff member.

- 2. Zryan Sadik, sponsored PhD Researcher based at CARISMA, Brunel University.

- 3. Priyanka Shinde, sponsored research associate at the trading research laboratory IIMCal.

- (i) We are pleased to announce our partnership with IRage Capital, a financial analytics firm which provides algorithmic trading services. IRage Capital has purchased our NATool kit in order to provide News enhanced trading algorithms for their institutional brokers and hedge fund clients. Joint R&D and product development is a salient aspect of this deal.

- (ii) OptiRisk Systems and TheySay Analytics of Oxford have entered into partnership discussions.

For further information please contact

Web: www.optirisk-systems.com Email: info@optirisk-systems.com Tel: +44 (0)1895 819 486/488 Twitter: @OptiRiskSystems LinkedIn: OptiRisk Systems

1. OptiRisk Staff Transport Management System (OSTMS):

OSTMS is a web based tool to automate employee pick-up and drop-off scheduling. This tool helps companies to reduce the waiting and travel time of the employees. OSTMS optimizes the routes in such a way that it results in fewer vehicles deployed. It also reduces total distance, time travelled and the overall transportation cost.

Please check the brochure in the following link:

http://www.slideshare.net/optirisk/optirisk-staff-transport-management-system

2. OptiRisk Over Dimensional Cargo Transport Management System (OODCTMS):

OODCTMS helps Organizations in the routing of the over dimensional / over sized cargo. It automates the planning process, which helps to locate routes that can accommodate the oversized cargo through various hurdles. Such hurdles are bridges, overpasses, tunnels, underpass, flyovers, etc. Such improvements results in higher customer satisfaction and transporter efficiency. OODCTMS being a web based tool can be accessed by multiple users from anywhere in the world at any time.

Please check the brochure in the following link:

http://www.slideshare.net/optirisk/optirisk-over-dimensional-cargo-transport-management-system

OptiRisk India has signed a contract with a billion dollar revenue company to study the current end-to-end supply chain and implement the next generation Business planning tool. This tool will help to automate the planning process and optimize various plans.

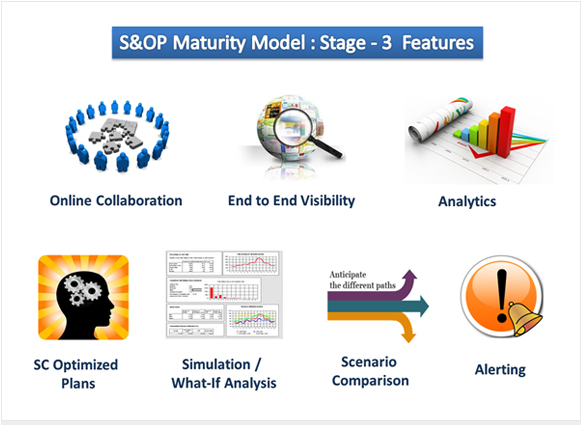

The proposed Solution will have the following features:

Implementing this solution will bring in the following benefits:

- 1. Improved top-line, bottom-line and ROI

- 2. Increase in long term shareholder value

- 3. Improvement in Customer service levels

Share this |

Credits |

|||

|

This Newsletter was compiled by Aqeela Rahman |